Retirement accounts are powerful instruments for wealth building and preservation because of their tax pros, growth probable, and legal protections. Here’s how they're able to enhance your wealth management approach and assist to take care of your wealth:

• Current market disruption and financial variables: The trading marketplace for the Structured Notes is likely to be risky and is likely to be disrupted or adversely influenced by numerous events. There is usually no assurance that occasions in the United States or in other places will not likely bring about industry volatility or that such volatility is not going to adversely have an affect on the price of the Structured Notes, or that financial and industry situations won't adversely influence the cost of the Structured Notes, or that financial and current market problems will never have some other adverse outcome. Sector disruption can adversely influence the functionality of the Structured Notes.

For instance, if an Trader has a good portion of their portfolio from the technologies sector and it encounters a downturn, their overall portfolio could undergo major losses. Having said that, by diversifying investments throughout sectors like healthcare, finance, and energy, they could mitigate the effects of just one sector's poor overall performance.

three. Trusts are A further worthwhile tool in estate arranging. They provide people today with greater Command over the distribution in their assets, together with the capacity to protect Those people assets from probable creditors or irresponsible beneficiaries. Trusts is often arrange throughout the person's life span (dwelling trusts) or on their death (testamentary trusts).

Most European precious metals refineries that develop gold ingots in gram denominations will likely launch one-ounce gold ingots. This very long-expression gold coin software has generated a fascinating selection of gold cash in different sizes and denominations.

Portfolio resilience is a straightforward thought, but offering on its find out here now guarantee needs a thoughtful method.

However, wealth preservation is essential for making certain very long-term economic stability and the ability to aid long run generations.

When lots of people make use of the phrases wealth preservation and wealth defense interchangeably, they confer with unique aspects of economic duty.

two. Estate Scheduling Lawyer: An estate arranging legal professional concentrates on developing authorized documents that define how your assets will probably be dispersed upon your Dying. They can help you draft a will, build trusts, and build strategies to attenuate estate taxes.

Tax performance scheduling: Minimizing tax liabilities by way of strategic intending to optimize wealth retention.

1. money advisor: A monetary advisor performs a vital position in wealth preservation by delivering detailed economic organizing companies. They may help you set practical plans, develop a personalized expense technique, and check your portfolio on a regular basis.

Precious metals, significantly gold, have extended served as a hedge from inflation and economic uncertainty. Over the past 20 years, gold has offered a median annual return of close to eight%, significantly outpacing inflation.

Preserving your wealth from prospective risks demands a comprehensive solution that mixes different asset protection strategies. Diversification, trusts, LLCs, insurance policy, offshore entities, and family members restricted partnerships all offer exceptional rewards and will be diligently regarded as dependant on your unique situations and goals.

Further than her authorized experience, Catherine offers transformational coaching to help consumers as well as their people by way of everyday living transitions.

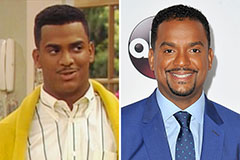

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Karyn Parsons Then & Now!

Karyn Parsons Then & Now! Suri Cruise Then & Now!

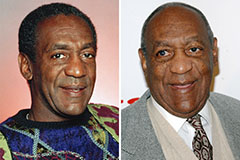

Suri Cruise Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now! McKayla Maroney Then & Now!

McKayla Maroney Then & Now!